Navigating the Aftermath of a Storm: Starting Your Roof Insurance Claim Journey

After a storm clears, homeowners may need to address roof repairs due to storm damage. In Southern Ohio, where weather can significantly impact homes, initiating the process for roofing insurance claims is an important step toward repairing the damage. Understanding how to file these claims is crucial to ensure you receive proper compensation for any form of damage.

The process for submitting a storm damage claim can be complex, but with the right knowledge and a reliable roofing contractor, you’ll be able to handle it effectively.

In this blog post, we’ll offer information on what to expect when filing a storm damage claim for roof damage and detail the steps to take for you to secure the necessary funds for repairs without extra stress. Keep reading to be well-informed on navigating the claims process efficiently.

Identifying and Assessing Roof Damage After a Storm

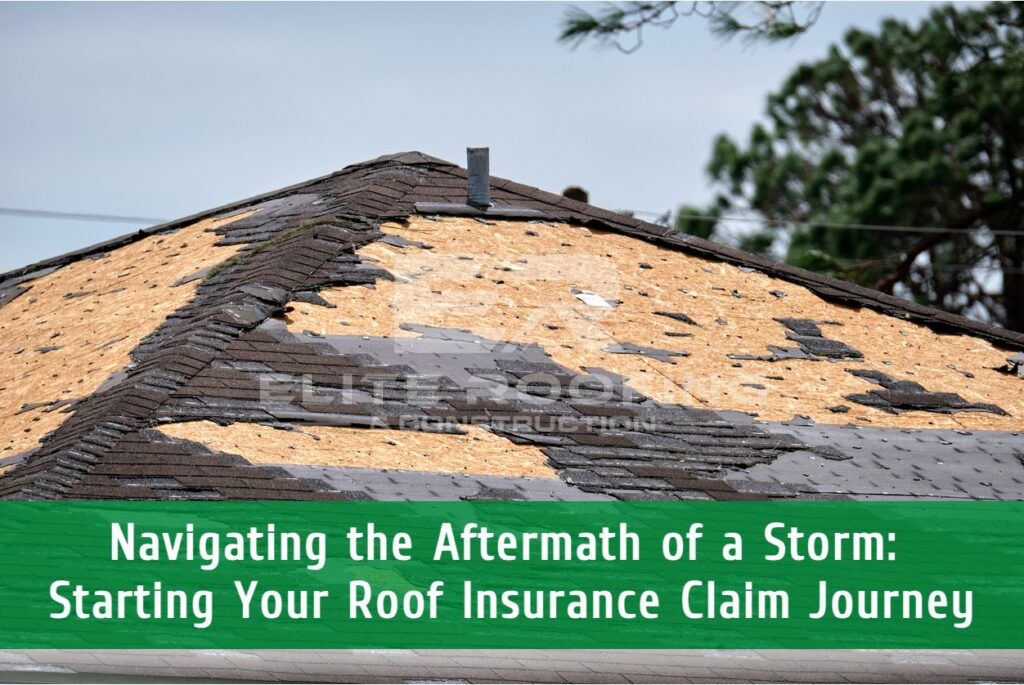

Once the storm has passed, it’s critical to promptly assess the condition of your roof in order to start the insurance claims process. In Southern Ohio, storms can be harsh, which makes quick identification and action crucial. Begin by examining your roof for obvious signs of damage such as missing shingles, dents, or leaks. For a more thorough inspection, consider hiring a professional roofing contractor. These experts can detect less obvious issues and provide a detailed report, which can be valuable when filing roof damage insurance claims.

At this stage, you’ll want to document all damage with photographs and take detailed notes in order to strengthen your claim.

The Essentials Parts of Filing Your Roof Damage Insurance Claim

Starting on the process of filing a roof insurance claim for storm damage requires a methodical approach, especially in regions like Southern Ohio where such events are not uncommon. The first step is to review your insurance policy thoroughly to understand what is covered under the terms of your contract. It’s also important to know the deadlines for filing roof damage insurance claims, as insurance companies often have specific time frames within which you must report the damage.

Once you have a clear understanding of your coverage, contact your insurance company to initiate the claims process. Be prepared to provide detailed information and evidence of the damage, which a trusted roofing contractor can help you gather. This professional can also assist in providing an accurate estimate for the cost of storm damage roof repairs.

What Storm Damage Is Covered by Insurance In Ohio?

In Ohio, the types of roof damage eligible for insurance coverage and claims generally include those caused by natural events that are covered under a standard homeowners insurance policy. This coverage typically encompasses damage from windstorms, hail, and severe weather conditions like tornadoes and thunderstorms. For example, if high winds have ripped a significant amount of shingles off your roof, or hail has created punctures or dents in your roofing material, these are likely to be covered by insurance.

It’s important to review your specific insurance policy for what exactly is covered, as exclusions and limits can vary. Keep in mind that damage resulting from lack of maintenance or wear and tear over time is usually not covered. Additionally, some policies may have separate deductibles for storm-related damage, especially in regions prone to certain events. To ensure eligibility for a claim, document the damage promptly after the event with photographs and detailed notes and contact your insurance company as quickly as possible.

What to Expect After Filing A Roof Storm Damage Insurance Claim: The Road to Restoration

After you’ve filed an insurance claim for storm damage, it’s important to know what comes next. The road to restoration involves several key steps, and being prepared can help ensure the process goes smoothly. Initially, an insurance adjuster will schedule a visit to assess the damage to your roof. They will review the evidence you’ve provided, such as photos and the contractor’s report, to determine the extent of the repair or replacement needed.

During this time, maintain open communication with your insurance company and respond promptly to any requests for additional information. It’s also wise to keep detailed records of all correspondence and decisions made throughout the claim process. You may need to obtain multiple repair estimates, and hiring a reliable roofing contractor, experienced with insurance claims, can be a great asset. They can help you navigate the intricacies of the process and provide essential support and documentation.

As you move forward, remember that patience is key. Insurance claims can take time, and it’s crucial to follow through with each step diligently. Rest assured, with these roof damage claim tips in hand, you’re well on your way to restoring your home to its pre-storm condition.

Preventing The Need To File Claims In The Future

Even though filing a claim may provide you with the money you need to get the necessary repairs or replacement after a storm, you’ll want to prevent the need to file another claim in the future, as your premium may increase with each claim.

Because of this, you’ll want to keep your roof in good condition, and the best way to do so is by following regular maintenance practices and considering these tips:

Conduct Regular Roof Inspections: Homeowners should ideally schedule regular inspections of their roofs twice a year or after major storms. These inspections can identify potential weak spots, missing or damaged shingles, and other issues like cracking or curling that might cause a roof to weaken further in a storm.

Upgrade Roofing Materials: It’s always best to invest in high-quality, durable roofing materials. If you get the chance to replace your damaged roofing material with new ones thanks to a successful claim, consider materials like metal panels or impact-resistant shingles. They may have a higher upfront cost but can withstand harsher conditions and provide better long-term protection.

Tree Maintenance: Homeowners should regularly trim trees around their property to prevent branches from breaking off and damaging the roof during a storm. Removing dead or rotting trees near the house can also reduce the risk of them falling onto the home during high winds.

Gutter Maintenance: Keeping gutters and downspouts clear is essential. Clogged gutters can lead to water accumulation and, during winter, ice buildup, which can cause significant damage to the roof and eaves. Ensuring that water is able to flow freely through gutters and away from the home helps prevent these issues.

Choosing the Right Ally for Insurance Claims and Repairs

When faced with the aftermath of storm damage, selecting a reputable roofing contractor for help during the inspection and repair part of the process can be beneficial. When choosing a roofing contractor to assist with your storm damage insurance claim, it’s important to select someone who is thorough and has the knowledge to do the project successfully. Look for someone who is able to provide a comprehensive inspection report that details all aspects of the damage. This report should be clear and well-documented, providing photographs and a full assessment that can support your claim.

A good contractor should also be willing to meet with your insurance adjuster to discuss the findings. This cooperation can help ensure that when the adjuster comes to your house they will have a full understanding of the extent of the damage. Additionally, verify that the contractor is licensed and insured, and check for a track record of integrity and customer satisfaction. Reviews and testimonials from previous clients can also be very helpful, and can show if a contractor has been successful helping clients during emergency situations.

Elite Roofing & Construction: Your Trusted Partner for Storm Damage

Don’t let storm damage leave your roof vulnerable. Contact Elite Roofing & Construction today at (937) 500-7663 to ensure your insurance claim is handled with expertise and care. Our experienced team specializes in navigating the complexities of roof insurance claims for storm damage, and can even provide immediate assistance with our roof tarping services. Trust Elite Roofing to assess and document the damage, communicate with your insurance provider, and ensure you receive the quality repairs you deserve. Take the first step towards restoration by reaching out to Elite Roofing & Construction today!